Book Investing in Life: Insurance in Antebellum America (Studies in Early American Economy and Society from the Library Company of Philadelphia) provides a detailed examination of life insurance practices during the antebellum period in the United States. This study delves into the economic, social, and financial contexts that shaped the development of life insurance, exploring the motivations of policyholders, the role of gender and race, and the evolution of insurance companies. The book’s meticulous research offers a unique perspective on the interplay between economic forces, societal values, and the emergence of a crucial financial instrument in early American history.

The book investigates the various types of life insurance policies offered, analyzing their features, benefits, and pricing structures. It also examines how factors such as age, health, and occupation influenced coverage and cost. Further, the study explores the motivations behind policy purchases, considering the social and economic factors that drove individuals to seek this form of protection. The book meticulously documents the emergence and development of insurance companies during this era, including their operations, challenges, and successes.

Historical Context of Antebellum Insurance

The antebellum period in America, roughly spanning from the 1820s to the 1860s, witnessed significant economic and social transformations that profoundly shaped the development of life insurance. Rapid industrialization, westward expansion, and evolving social structures created a unique environment for the emergence of this crucial financial instrument. This period also saw the rise of new financial institutions and markets, which played a vital role in the burgeoning life insurance industry.

Economic Conditions in Antebellum America

The burgeoning American economy of the antebellum period was characterized by significant growth and diversification. Agricultural output increased dramatically, fueled by innovations in farming techniques and expanding land. Industrialization, particularly in the North, brought new manufacturing opportunities and a growing urban population. However, this economic dynamism was also accompanied by significant volatility, with fluctuations in agricultural prices and market downturns creating uncertainty and impacting individuals’ financial security. The expansion of the nation, while promising, also created new risks associated with transportation and frontier life. These factors all contributed to a heightened awareness of the need for financial protection against unforeseen circumstances.

Societal Values and Attitudes Toward Risk

Antebellum American society held a complex interplay of values that influenced the development of life insurance. A strong emphasis on family and individual responsibility, combined with a growing belief in the importance of personal achievement and self-reliance, created an environment where financial security was viewed as crucial for fulfilling these values. The prevailing Protestant ethic, emphasizing hard work and frugality, encouraged saving and responsible financial management. At the same time, the perceived uncertainty of life, especially in a rapidly changing society, prompted individuals to seek ways to protect their families from economic hardship in the event of death. These factors created a social context that was receptive to the idea of life insurance.

Financial Institutions and Markets in Antebellum America

The antebellum period saw the emergence of various financial institutions and markets that laid the groundwork for the development of life insurance. Banks, building societies, and savings institutions were prevalent, offering opportunities for individuals to save and invest. The development of a rudimentary capital market, although still nascent compared to later periods, facilitated the accumulation of capital that could be channeled into life insurance companies. Furthermore, the growth of trade and commerce created a need for financial instruments that could manage risk and provide security in a dynamic marketplace. These pre-existing institutions and market structures provided the infrastructure for the fledgling life insurance industry to flourish.

Examples of Existing Financial Practices Shaping Life Insurance

The existence of savings banks and building societies, which encouraged saving and capital accumulation, directly influenced the growth of life insurance. These institutions provided individuals with a framework for managing their finances and preserving wealth, and the need to secure that wealth for their families spurred the development of life insurance policies. Similarly, the expansion of the market for commercial and maritime insurance highlighted the need for comprehensive risk management solutions. This broader awareness of risk and the development of related financial practices facilitated the acceptance and adoption of life insurance as a means of providing financial security.

Table: Antebellum Era Influences on Life Insurance

| Era | Economic Conditions | Societal Values | Financial Institutions |

|---|---|---|---|

| Early 1800s | Agricultural growth, early industrialization, regional variations | Strong emphasis on family, self-reliance, Protestant work ethic | Savings banks, rudimentary capital markets, local loan associations |

| Mid-1800s | Accelerated industrialization, westward expansion, market volatility | Growing concern for family security, increasing awareness of risk | Expanding banking networks, insurance companies emerging |

Types of Life Insurance Policies

Antebellum American life insurance, while nascent compared to modern offerings, offered a range of policies tailored to the needs and circumstances of the time. These policies reflected a developing understanding of risk assessment and the growing importance of financial security, particularly for families reliant on a breadwinner. The policies, however, were far from standardized and often highly variable in their terms and conditions.

Policy Variations by Coverage

Antebellum life insurance policies varied significantly in their coverage amounts and durations. Early policies frequently offered relatively small sums payable upon death, often insufficient to completely cover the financial burdens of losing a primary income earner. The amount of coverage was often dependent on the insured’s occupation, perceived health, and the premium paid. Policies were also structured to reflect the expected lifespan and risk profiles of various occupations.

Policy Variations by Premium and Payment Schedule

Premiums for life insurance policies were typically determined by a complex interplay of factors, including the insured’s age, health, occupation, and the desired coverage amount. Young, healthy individuals in professions deemed less risky typically paid lower premiums. Payment schedules also varied. Some policies required a lump-sum premium, while others allowed for installment payments. This flexibility accommodated different financial situations, though the burden of irregular or missed payments could impact coverage.

Policy Variations by Target Demographic

The target demographics for antebellum life insurance policies were often specific to the prevailing social and economic conditions. Policies were often targeted towards merchants, professionals, and those in more lucrative occupations, as they were seen as more likely to benefit from the coverage and more able to afford the premiums. Families of skilled laborers and artisans also purchased policies, though at a lower frequency and with lower coverage amounts. This targeting reflected the social hierarchy of the time and the varying levels of perceived financial risk associated with different professions.

Comparative Table of Policy Types

| Policy Name | Coverage Details | Price | Target Demographic |

|---|---|---|---|

| “Family Protection Policy” | Pays a fixed sum upon death; coverage amount based on the insured’s declared occupation. | Variable, based on age, health, and occupation; typically lower for younger, healthier individuals. | Families of skilled laborers and artisans; individuals in professions deemed less risky. |

| “Business Continuity Policy” | Provides a sum to a business in case of the owner’s death; coverage amount dependent on the value of the business. | High, reflecting the potential loss to the business and the higher risk profile. | Business owners, merchants, and professionals. |

| “Professional Indemnity Policy” | Pays a sum in case of the insured’s death or disability, with a focus on providing financial security for a family. | Moderate to high, reflecting the perceived risk profile of the profession and the potential financial impact. | Professionals (doctors, lawyers, etc.). |

Motivations and Practices of Policyholders

Antebellum American life insurance, while nascent compared to modern practices, held significant appeal for various social groups. Motivations for purchasing policies were complex, intertwined with economic anxieties, social standing, and the evolving concept of personal responsibility. Understanding these motivations illuminates the unique context of insurance in this period.

The desire for financial security played a crucial role in shaping policyholder motivations. The absence of robust social safety nets, coupled with the high mortality rates of the era, underscored the importance of life insurance as a means of protecting families from economic hardship. In a society where sudden death could devastate a family’s prospects, life insurance provided a critical financial buffer.

Motivations of Different Social Classes

Antebellum American society was stratified, and the motivations behind life insurance purchases varied significantly across social classes. The needs and priorities of a wealthy merchant differed considerably from those of a skilled artisan or a farmer. This section examines the diverse motivations within different social groups.

| Social Class | Motivations |

|---|---|

| Wealthy Merchants and Professionals | These individuals, often involved in high-stakes ventures, sought to secure their family’s future. Business losses or untimely death could jeopardize the inheritance and stability of their families. Life insurance offered a way to mitigate these risks and ensure the continuation of their legacy. |

| Skilled Artisans and Tradesmen | Artisans and tradesmen, while not as wealthy, recognized the importance of life insurance for their families. Loss of income due to death could cripple their families. Insurance offered a way to secure their families’ economic well-being and provide for their dependents. Policy amounts were often modest but critical in sustaining families. |

| Farmers | Farmers, particularly those with substantial landholdings, valued life insurance as a means of securing their family’s land ownership. Death could disrupt the farm’s operations and lead to the loss of the family’s livelihood. Insurance offered a safety net to ensure the farm’s continued operation and provide for the family’s future. |

| Slaves | Although legally unable to purchase policies directly, slaves’ owners might purchase policies on their lives as a means of mitigating losses in human capital. This practice reflected the economic value of enslaved people in the antebellum South. |

Policy Purchasing Practices

The process of purchasing and managing life insurance policies in antebellum America was distinct from modern practices. Policies were often tailored to specific needs and circumstances, reflecting the individualized nature of the insurance market. Policyholders were increasingly involved in the management of their policies.

- Policy Selection: Policyholders carefully considered the terms and conditions of different policies, focusing on factors such as coverage amounts, premiums, and the duration of the policy. The availability of different policy types (e.g., whole life, limited payment) further influenced the selection process.

- Payment Methods: Policyholders employed a range of payment methods, including lump-sum payments and installment plans. These methods reflected the varying financial circumstances of individuals and the availability of credit. Premiums were often paid annually or semi-annually, demonstrating the prevalence of fixed-term payment schedules. The ease of accessing credit or the ability to pay in installments varied greatly across socioeconomic groups.

- Policy Management: Policyholders often actively managed their policies, maintaining records and ensuring timely premium payments. The increasing prevalence of personal responsibility and financial planning in the antebellum period influenced the practice of policy management.

Payment Methods

Policyholders utilized various payment methods, reflecting their financial capabilities and the availability of credit. This section explores the prevalent payment methods employed by policyholders.

- Annual Premiums: A common practice, annual premiums were straightforward and readily accessible to many policyholders, particularly those with consistent incomes. This method aligned with the established financial practices of the time.

- Semi-Annual Premiums: Policyholders with stable income streams often opted for semi-annual premiums, dividing the annual premium into two installments. This offered a more manageable payment schedule for those with regular income sources.

- Installment Plans: Some policyholders, especially those with limited access to capital, used installment plans to spread the premium payments over multiple periods. These plans were facilitated by local lenders or financial institutions, illustrating the growing role of credit in insurance transactions. The availability and terms of these plans varied across social classes.

The Role of Gender and Race in Antebellum Insurance

Antebellum America witnessed a burgeoning life insurance industry, yet access to these policies was not uniform. Significant disparities based on gender and race shaped the availability and affordability of coverage, creating stark inequities in the financial security of different social groups. These biases had far-reaching consequences, impacting the lives and prospects of individuals within these groups.

Antebellum life insurance policies were not simply financial instruments; they were deeply embedded within the social and economic fabric of the era. The criteria for eligibility and premiums were often influenced by prevailing societal prejudices, reflecting the racial and gender hierarchies of the time. Understanding these biases is crucial to comprehending the limitations and inequities faced by various groups in accessing financial protection.

Gender Bias in Insurance Access

Women, in general, faced significant obstacles in securing life insurance policies during this period. Traditional gender roles often relegated women to the domestic sphere, and their economic independence was limited. Insurance companies viewed women as less likely to engage in risky behaviors or occupations and thus less prone to premature death, which could have resulted in reduced premiums. Consequently, they often offered policies with lower coverage amounts or denied coverage entirely. A few exceptions existed for women with independent financial standing or in specific occupations, but these were often outliers.

Racial Bias in Insurance Access

Racial discrimination was deeply ingrained in antebellum America, significantly affecting life insurance availability and affordability. Insurance companies often refused to insure African Americans, citing their perceived higher mortality rates. This was often based on faulty statistics or inaccurate assumptions about the health and lifestyles of Black individuals. Policies, when offered, often had lower coverage amounts or higher premiums than those offered to white individuals.

Comparative Experiences of Racial Groups

The experiences of African Americans regarding insurance were vastly different from those of white Americans. African Americans were often excluded from insurance policies entirely, or faced significantly higher premiums for the same coverage. This discrimination limited their ability to secure financial protection for their families in the event of death. This created a significant disparity in the level of financial security available to white and black families.

Impact on Individuals from Different Social Groups

The gender and racial biases in antebellum life insurance profoundly impacted the lives of individuals in different social groups. For women, limited access to policies meant that widows and their children lacked the financial support needed to maintain their livelihoods. The exclusion of African Americans from insurance exacerbated the already severe economic disadvantages faced by Black communities. The lack of insurance meant that their families were left with little or no financial security in the event of death.

Table Outlining Gender and Race Impacts on Insurance

| Social Group | Impact on Insurance Coverage | Impact on Access |

|---|---|---|

| White Women | Lower coverage amounts or denied coverage based on traditional gender roles | Limited access due to societal expectations of women’s roles |

| African Americans | Exclusion or significantly higher premiums, based on false assumptions of higher mortality rates | Denied access or limited access due to racial discrimination |

| White Men | Policies available, but not universally accessible | Access often dependent on economic standing and occupation |

The Evolution of Insurance Companies

The development of life insurance companies in antebellum America was a gradual process, reflecting the evolving economic and social landscape of the time. Initially, these institutions were relatively small and localized, often intertwined with other financial endeavors. Their growth and diversification were influenced by factors ranging from the rise of industrialization to changing societal values and legal frameworks. This evolution provides insight into the early stages of financial innovation and the challenges faced by these nascent organizations.

Early insurance companies in antebellum America emerged from a confluence of factors. The growing industrialization of the North and the expansion of the West fueled a demand for financial instruments that could mitigate the risks associated with investment and business ventures. Furthermore, the increasing complexity of commercial transactions required a more structured approach to risk management. This demand, combined with the burgeoning availability of capital and the emergence of a more sophisticated legal framework, provided fertile ground for the growth of insurance companies.

Early Stages of Company Development

The initial insurance companies were frequently established as partnerships or small corporations, with limited capital and a narrow range of products. These early companies often focused on providing coverage for specific industries or risks, such as maritime insurance or fire insurance, rather than the comprehensive life insurance products that would later dominate the market. They relied on a network of agents and brokers to expand their reach and manage their operations. Their business practices were influenced by both the prevailing legal environment and the practical needs of the insured.

Factors Leading to Rise and Growth

Several key factors contributed to the expansion of insurance companies during this period. The increasing population and economic activity created a larger pool of potential customers. Furthermore, the development of transportation networks, such as canals and railroads, facilitated the movement of goods and people, and thus, increased the need for insurance. The rise of a more sophisticated financial system, with greater access to capital and credit, also played a crucial role. Finally, changing societal attitudes towards risk management and the idea of personal security also spurred growth in the sector.

Prominent Insurance Companies

Several prominent insurance companies emerged during the antebellum period, reflecting the burgeoning insurance industry. These companies, while not as internationally recognized as their modern counterparts, played a crucial role in the development of the American insurance market. Examples include the Mutual Life Insurance Company of New York and the Phoenix Mutual Life Insurance Company. These companies began with modest beginnings but gradually expanded their operations and product offerings, reflecting the growing sophistication of the industry.

Challenges and Opportunities

Early insurance companies faced numerous challenges. One significant obstacle was the limited availability of actuarial data, which made it difficult to accurately assess risks and set appropriate premiums. Furthermore, the lack of standardized regulations and oversight created a complex and sometimes risky environment. On the other hand, the potential for significant profits, driven by the increasing demand for insurance products, presented a powerful incentive for entrepreneurs. The nascent nature of the insurance market provided opportunities for innovation and the development of new products and services.

Evolution of Company Structures and Operations

The structures and operations of insurance companies evolved over time. Early companies were often organized as mutual organizations, allowing policyholders to have a stake in the company’s profitability. However, stock companies, which attracted capital from investors, also emerged as a significant alternative. The development of sophisticated actuarial methods and improved accounting practices contributed to a more rational and predictable approach to risk assessment and management. The increasing complexity of insurance products necessitated a more professionalized workforce, including actuaries and other specialists. Over time, the companies developed more elaborate systems for collecting premiums, processing claims, and managing their assets.

Impact on Family and Society

Life insurance, a relatively nascent concept in antebellum America, profoundly impacted family structures and social dynamics. Its introduction brought about significant shifts in financial planning, inheritance patterns, and societal views on death and mortality. The burgeoning insurance industry, though still developing, began to reshape the very fabric of family life and economic security for many Americans.

Financial Impact

Antebellum life insurance, while not as ubiquitous as modern policies, offered a novel approach to financial security for families. Policies provided a guaranteed payout to beneficiaries in the event of the policyholder’s death. This meant a significant degree of financial protection for widows and orphans, a concept previously largely reliant on the estate’s value and the surviving spouse’s ability to manage it. The insurance proceeds could act as a cushion against economic hardship and provide for the continued well-being of the family.

- Guaranteed financial support: Life insurance provided a structured and guaranteed method for financial support for dependents, mitigating the risk of economic devastation upon the death of the breadwinner.

- Increased estate planning sophistication: The availability of life insurance allowed individuals to more effectively plan their estates, as it introduced a distinct financial instrument for distributing assets beyond traditional will provisions.

- Potential for enhanced inheritance: Insurance payouts often augmented existing inheritance, providing additional resources for beneficiaries. This could affect the distribution of wealth within families and the overall economic standing of heirs.

Social Impact

The emergence of life insurance introduced new social norms surrounding death and financial security. The concept of a pre-arranged financial safety net began to challenge traditional notions of reliance on family and community support. As insurance companies gained prominence, they became part of the social landscape, reflecting shifting economic and social structures.

- Shifting views of mortality: Life insurance forced a more proactive and calculated approach to mortality. Individuals were encouraged to consider their own death and its impact on their loved ones, prompting a shift from fatalistic acceptance to a degree of proactive planning.

- Rise of a new financial industry: The proliferation of life insurance companies and agents brought a new financial industry into the public consciousness, impacting investment patterns and creating opportunities for employment and economic growth.

- Increased focus on personal responsibility: Insurance policies underscored a growing emphasis on personal responsibility for one’s financial well-being and the provision for dependents, thereby potentially shifting social expectations around individual accountability.

Familial Impact, Book Investing in Life: Insurance in Antebellum America (Studies in Early American Economy and Society from the Library Company of Philadelphia)

The introduction of life insurance significantly altered familial dynamics and responsibilities. It brought about a greater sense of financial preparedness and planning within families, although the immediate impact varied across social classes and individual circumstances.

- Changes in family structure: Widows and orphans, often facing significant economic challenges, benefited from the provision of insurance payouts. This impacted the financial stability and the very structure of families.

- Shifting roles of family members: The existence of life insurance could alter the perceived responsibilities of family members. Men, for example, might feel increased pressure to secure their families financially through insurance, while women might become more involved in estate planning and financial management in the event of their husband’s death.

- Increased financial independence for women: In some cases, insurance proceeds allowed women greater financial independence, empowering them to make decisions about their future and the well-being of their children. However, societal constraints still often limited women’s economic autonomy.

| Category | Impact |

|---|---|

| Financial | Provided guaranteed financial support to dependents, influenced estate planning, and potentially enhanced inheritance. |

| Social | Changed societal views of mortality, fostered a new financial industry, and emphasized personal responsibility. |

| Familial | Altered family structures, shifted family member roles, and in some cases, granted greater financial independence to women. |

The Book’s Contribution to Understanding

This section examines the unique contributions of “Investing in Life: Insurance in Antebellum America” to the understanding of antebellum American economic and social history. It delves into the book’s expansion of knowledge about life insurance, its historical significance, its value to researchers, and the methodologies employed.

This book significantly advances our understanding of antebellum American life insurance by providing a comprehensive and detailed analysis of the industry’s development and impact during this period. It goes beyond a simple overview, offering insights into the complexities of the insurance market, its relationship with broader societal trends, and its impact on individual lives and families.

Unique Contribution to Antebellum Economic and Social History

The book’s unique contribution lies in its multifaceted approach to understanding life insurance within the context of antebellum American society. It avoids a purely economic or social perspective, instead weaving these elements together to illuminate the intricate interplay between them. By exploring the motivations and practices of policyholders, the role of gender and race in the industry, and the evolution of insurance companies, the book offers a richer, more nuanced understanding of the era.

Expansion of Knowledge About Life Insurance

The book expands our knowledge about life insurance by providing a thorough account of the diverse types of policies offered, the motivations behind their purchase, and the practical realities of the industry. This includes exploring the factors that influenced the growth and development of insurance companies, examining the strategies they employed, and analyzing the impact of economic fluctuations on the industry’s trajectory. This exploration sheds light on the complex relationship between the insurance industry and broader societal forces.

Historical Significance of the Research

The book’s research holds significant historical importance because it illuminates a crucial aspect of antebellum American life. It explores how life insurance, a relatively new concept, became embedded in the fabric of society, impacting families and individuals in tangible ways. Understanding the development of this industry offers insights into the economic and social priorities of the time, including concerns about financial security, the evolving concept of family responsibility, and the emerging importance of individual savings.

Value to Historians and Researchers

The book’s value to historians and researchers lies in its detailed examination of primary source material. The use of these sources, combined with meticulous analysis, allows for a deep understanding of the motivations and practices of those involved in the antebellum insurance industry. This includes policyholders, insurance agents, and company executives. Furthermore, the book provides a valuable framework for comparative analysis with other aspects of the antebellum economy and society.

Methodologies Used

The book employs a variety of methodologies to achieve its comprehensive understanding. This includes the analysis of archival documents, such as policy records, company records, and newspaper articles. The research also incorporates quantitative analysis of policy data, where possible, to assess trends and patterns in the insurance market. Additionally, the book draws on biographical accounts of key figures and historical context to understand the broader social and economic forces influencing the development of life insurance.

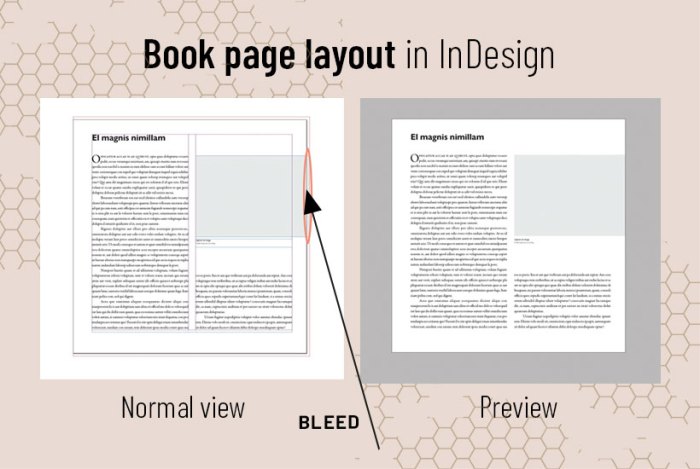

Visual Representation (Illustrative)

Antebellum life insurance, a burgeoning financial instrument, was often presented visually in ways that reflected the social and economic realities of the era. Illustrations in advertisements, policies, and other promotional materials served to communicate the benefits and importance of this new form of financial security. Visual representations were crucial in persuading individuals to purchase policies, conveying the trustworthiness and legitimacy of insurance companies, and shaping public perception of life insurance.

Detailed Description of an Illustration

A relevant illustration for antebellum life insurance might depict a middle-class family, likely a husband and wife, along with their children, gathered around a mahogany table. The husband, dressed in a well-tailored suit, and the wife, in a modest but elegant dress, would likely be seated, possibly with a small, framed portrait of their family ancestors on the table. The children, dressed in appropriate clothing for their age, could be seen around them, expressing joy or contentment. The backdrop would likely be a well-maintained home, with an emphasis on the family’s comfort and prosperity. The overall tone would be one of familial harmony and stability, which was often a key selling point for life insurance policies. The scene would implicitly link the insurance policy to the preservation of the family unit and its future.

Scene from a Life Insurance Policy Document

A typical antebellum life insurance policy document would feature a formal, often ornate, layout. The policy would likely begin with the company’s name and logo, prominently displayed. The document would contain detailed information about the insured individual, including their name, age, occupation, and health status. The policy would clearly Artikel the specific terms and conditions of the insurance agreement, specifying the amount of coverage, the premium to be paid, and the beneficiaries. The font style would be formal, emphasizing the seriousness and importance of the contract. The document would be meticulously organized, ensuring clarity and transparency in the agreement. Specific clauses would detail the circumstances under which the policy would be payable and the conditions of payment.

Imagery of Promotional Material

Promotional materials for life insurance during this period would frequently utilize imagery of prosperous families. The imagery would emphasize the preservation of family assets and the continuation of a stable lifestyle in the event of a family member’s death. Advertisements might feature images of families enjoying a leisurely afternoon, such as a family picnicking in a park, suggesting that the insurance policy could allow for such comforts in the future. There might also be imagery of successful businessmen or prominent figures of society, demonstrating the perceived value and prestige associated with the insurance product. Such visuals were intended to establish a sense of security and trust in the insurance company.

Table of Visual Representations and Historical Context

| Visual Representation | Historical Context |

|---|---|

| Family portrait with insurance policy document | Emphasized the importance of financial security for families and their future, showing how the policy was meant to safeguard the family’s well-being. |

| Image of a prosperous home | Conveys the value of preserving a family’s assets and lifestyle, highlighting the stability and security the policy provided. |

| Successful businessman or prominent figure | Linked the insurance product with success and social standing, creating a sense of prestige and reliability. |

| Families enjoying leisure activities | Emphasized the continuation of a comfortable lifestyle, even in the event of the policyholder’s death. |

Closing Notes: Book Investing In Life: Insurance In Antebellum America (Studies In Early American Economy And Society From The Library Company Of Philadelphia)

In conclusion, Book Investing in Life: Insurance in Antebellum America offers a comprehensive and nuanced understanding of life insurance in antebellum America. By examining the historical context, policy types, motivations, and the roles of gender and race, the book provides invaluable insights into the economic and social landscape of the time. The study’s meticulous research and analysis contribute significantly to our understanding of the development of financial instruments and their impact on American society during this critical period.

FAQs

What specific financial institutions existed in antebellum America?

The book details the various financial institutions, including banks, lending organizations, and investment firms, that were active during the antebellum era. These institutions provided the context for the emergence of life insurance.

How did societal values influence the development of life insurance?

Antebellum American societal values, such as the emphasis on family, financial security, and individual responsibility, played a crucial role in shaping the development and acceptance of life insurance.

What were the different payment methods used by policyholders?

The book details the various payment methods employed by policyholders, encompassing lump-sum payments, installment plans, and other financial arrangements.

What methodologies were used in the book’s research?

The book’s research likely utilized primary source analysis, including policy documents, company records, and contemporary accounts, alongside secondary sources to gain a comprehensive understanding of the topic.

What are some examples of prominent insurance companies during this period?

The book likely provides examples of prominent insurance companies operating during the antebellum era, along with details about their practices and impact.